EMEA BUSINESS TRAVEL REPORT Q2 – Accommodation & Aviation

- Accommodation: FCM global corporate data shows most capital cities are still significantly down in ARR vs 2019; London-34%, Berlin-31% and Johannesburg-34%

- Aviation: FCM EMEA data shows a +93% increase in corporate travellers from the previous Q1-2021 period, with average ticket prices for Q2-2021 have increased +32% vs Q1-2021

The quarterly report from FCM uses global data sourced from FCM corporate bookings for travel during April to June 2021 (Q2-2021) and compares the data to January – March 2021, as well as data from 2020 and 2019.

The full whitepaper can be downloaded here – EMEA Trends Report

Accommodation:

Q2-2021 saw the beginnings of recovery and steady growth in hotel occupancy levels and demand across EMEA. The UK leads Europe with occupancy reaching 65% at the end of May 2021, just two weeks after the opening of hotels to leisure travellers. This is up from a low of just 10% occupancy in January 2021, as reported by STR.

Advance bookings for September 2021 and beyond are only -5% down on the same period in 2019, as confidence grows. Q1-2021 85% of bookings were made within 7 days of arrival, compared to only 20% in Q2-2021.

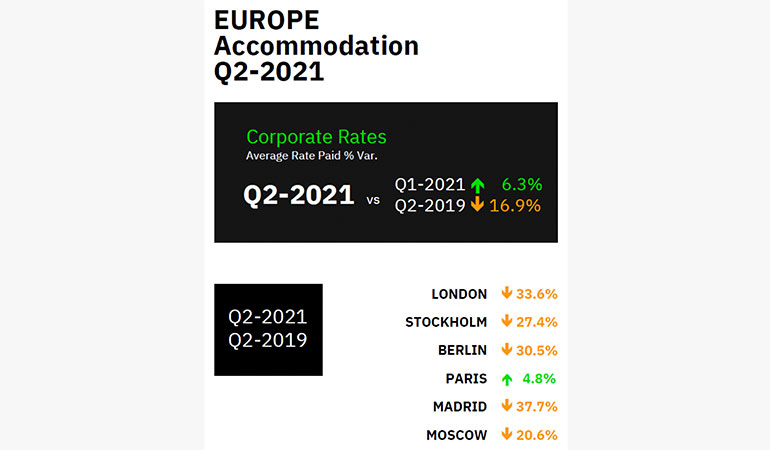

Forecast rates have also shown signs of recovery in Q2-2021, up +6-8% across the region overall compared to Q1-2021.

FCM global corporate data shows most capital cities are still significantly down in ARR vs 2019; London -34%, Berlin -31% and Johannesburg -34%. However, regional cities and key leisure destinations have had strong demand reporting rate increases above 2019 levels; Dubai +45% and Cornwall, UK +50%.

Rates are forecast to continue to grow for the remainder of the year in line with the increase in demand from both leisure and business travellers.

COVID-19 has accelerated the need for hotels to embrace technology to improve the guest experience. In 2021, 41% of hotels globally plan to invest in new technology to elevate existing services, as reported by Amadeus April 2021.

Technology changes and new hotel apps will uplift guest experiences and allow for further personalisation of stays through services such as contactless check-in, mobile room keys and in-room service ordering via an app.

The removal of many in-room amenities and paperwork to an ‘on-demand’ option has also helped hotels to reduce waste and meet sustainability goals.

Rates in USD:

Aviation:

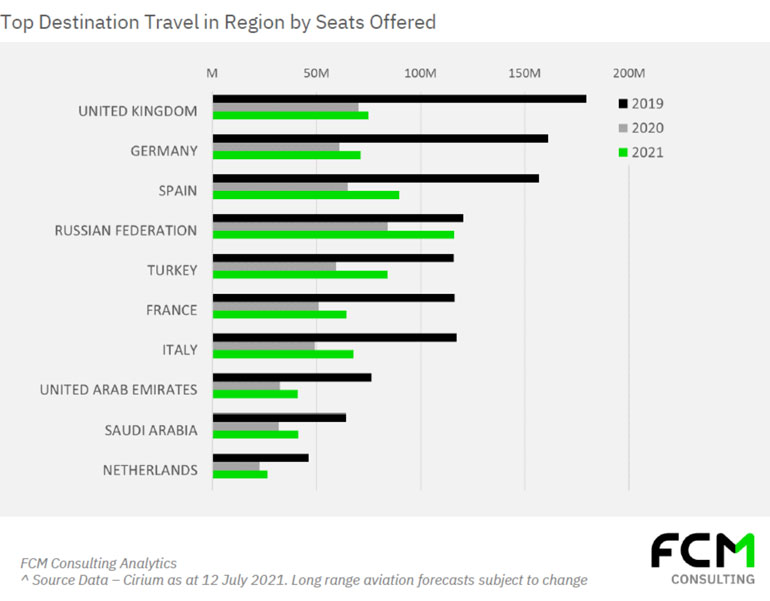

In Q2-2021 the EMEA region continued to open up air travel, growing frequency and city pair volumes with an additional +53M seats in destination on Q1-2021 volumes.

Government regulations remain fluid with sudden changes to lockdowns and travel corridors as fully vaccinated travellers grow week-to-week. Airports continue to reopen and close terminals through Europe, most notable at Frankfurt Airport Terminal 2

The European Digital COVID pass went live on 01 July 2021, and discussions continue with the integration of the UK’s NHS digital app.

ACI (Airports Council International) predicts EMEA to remain aviation’s worst-affected region by loss of air passenger revenue, with expected volumes of more than -$37.5B down in 2021 vs 2019.

The Middle East is likely to see the biggest reduction in flights, down almost -59% on 2019, against -58% in Europe.

FCM EMEA data shows a +93% increase in corporate travellers from the previous Q1-2021 period, with the majority of uplift attributed to European growth. Average ticket prices for Q2-2021 have increased +32% vs Q1-2021.

-Ends-

Notes to Editors:

This report was prepared by the FCM Consulting Analytics team, which forms part of FCM. All materials presented in this report, unless specifically indicated otherwise, is under copyright and proprietary to FCM. Information contained herein, including projections, has been obtained from materials and sources believed to be reliable at the date of publication.

For further press information, please contact:

Hannah Carlisle | Emma Arthurs | Katarina Gocoliakova

Rooster PR

T: +44 (0)20 3440 8924

E: [email protected]

About FCM:

Discover the Alternative

FCM is one of the largest travel management companies in the world, and the flagship global business travel division of Flight Centre Travel Group. Operating in over 97 countries across the world, FCM’s team exists on a truly global scale. They’re all about supporting each other and staying connected, so that travellers know they’re in good hands, no matter where they are in the world.

Globally connected, flexible, and a little unconventional — FCM make sure that wherever travellers are going, they can do it their way. Whether customers have regular international travel needs, take single trips at the last-minute, or want to consolidate their business travel services and costs across multiple countries — FCM’s global network has the experience, reach and negotiating strength needed in a travel partner.

Discover the alternative at www.fcmtravel.com